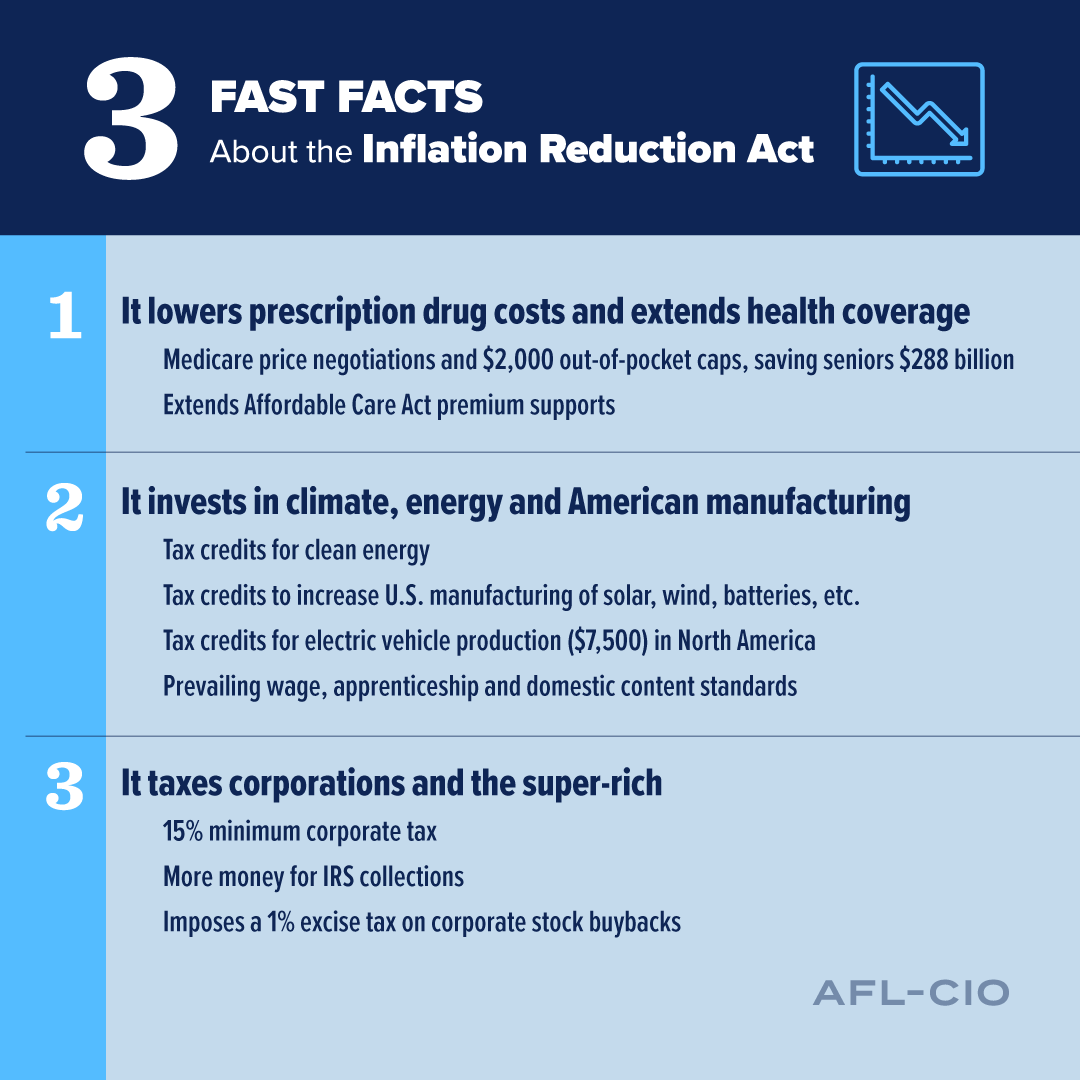

The US House of Representatives passed the Inflation Reduction Act on August 12, 2022. The comprehensive legislation, approved by the Senate on August 8, 2022, will be signed into law by President Joe Biden later this week. It is designed to lower health care and energy costs, combat climate change, and increase taxes on large corporations. Major provisions of the bill include:

Climate Change

A bulk of the $430 billion in new spending — $369 billion — will be used to fight climate change and boost the use of clean energy. More than $60 billion will be used to build clean energy sources, such as wind turbines. Funds have also been set aside to encourage auto manufacturers to start or transition to electric vehicle production. US consumers will receive a tax credit of up to $7500 for purchasing an electric vehicle and rebates for installing solar roofs or switching to energy-efficient appliances. The bill's authors believe the combined measures will help decrease US greenhouse gas emissions by 40 percent by 2030.

Health Care Costs

For the first time, Medicare — the health insurance plan available to Americans over the age of 65— will be able to directly negotiate the price of the most expensive drugs with drugmakers. Starting in 2025, Medicare recipients will have to pay no more than $2000 annually for prescriptions. The law also limits the price of insulin — used to control blood sugar in people with type 1 diabetes — to $35 per month for those on Medicare. Health coverage benefits provided under the Affordable Care Act will also be extended through 2025.

Taxation Changes

Companies with over $1 billion in annual profits must pay at least 15 percent in taxes. Those that decide to buy back their shares will be assessed a special 1 percent tax. Stock buybacks, which reduce the number of shares available in the public market, are a popular tactic to create value for existing shareholders. The legislation also allocates much-needed funds for the Internal Revenue Service to enhance tax collection measures and pursue tax evaders.

The tax measures are expected to generate up to $300 billion in annual revenues. US officials believe the funds could substantially reduce the fiscal budget deficit — the difference between what the federal government spends and what it collects — which was $211 billion as of July 2022. Some analysts believe reducing the deficit will help lower consumer prices and curb inflation.

Resources: CNN.com, NPR.org, CBSnews.com, wri.org