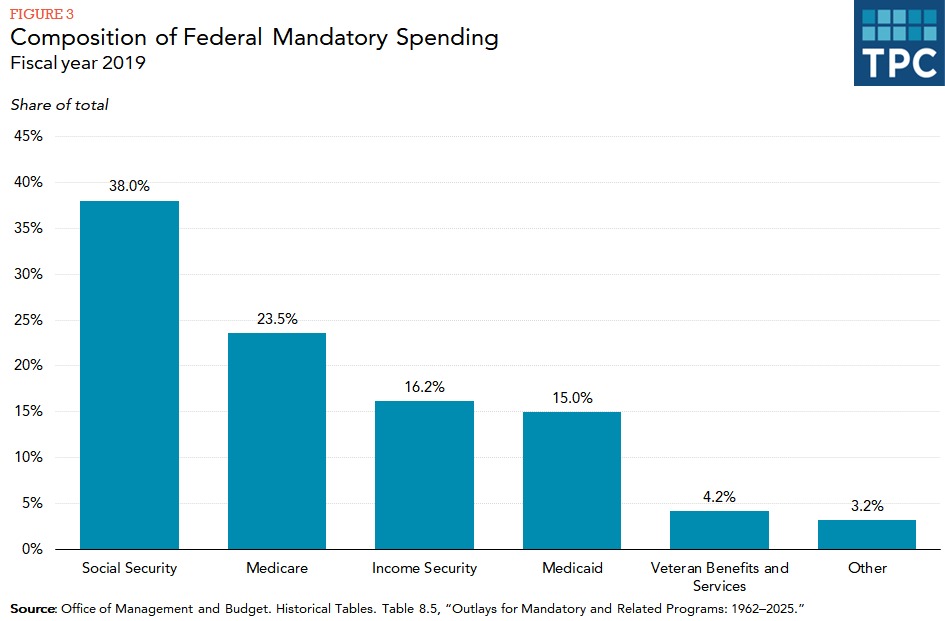

On May 1, 2023, US Treasury Secretary Janet Yellen urged lawmakers to raise the debt ceiling immediately. She warned that if the US government were not allowed to borrow more, it would be unable to meet its obligations by early June 2023. They include things like Social Security and Medicare payments. The government would also be unable to make interest payments on money borrowed in the past. This would result in a US debt default.

What is the debt ceiling? What happens if the lawmakers do not raise it in time? Read on . . .

The debt ceiling

The debt ceiling is the amount of money the US government can legally borrow to pay for its programs, services, and other expenses. Once it reaches this limit, it cannot borrow more money without approval from the US Congress. Raising the debt limit does not authorize any new spending. It just allows the country to pay for existing obligations.

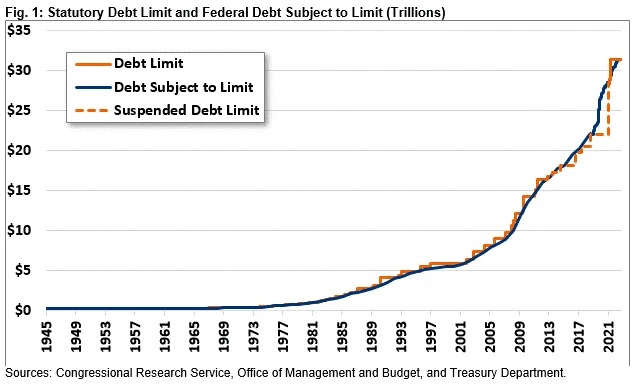

The debt limit was established in 1917 to allow the government to issue bonds to finance US efforts in the First World War. The initial limit was just a few billion dollars. While this was considered a lot of money at the time, it proved insufficient within just a few years. US lawmakers have increased the amount several times since.

Why does the government need to borrow money?

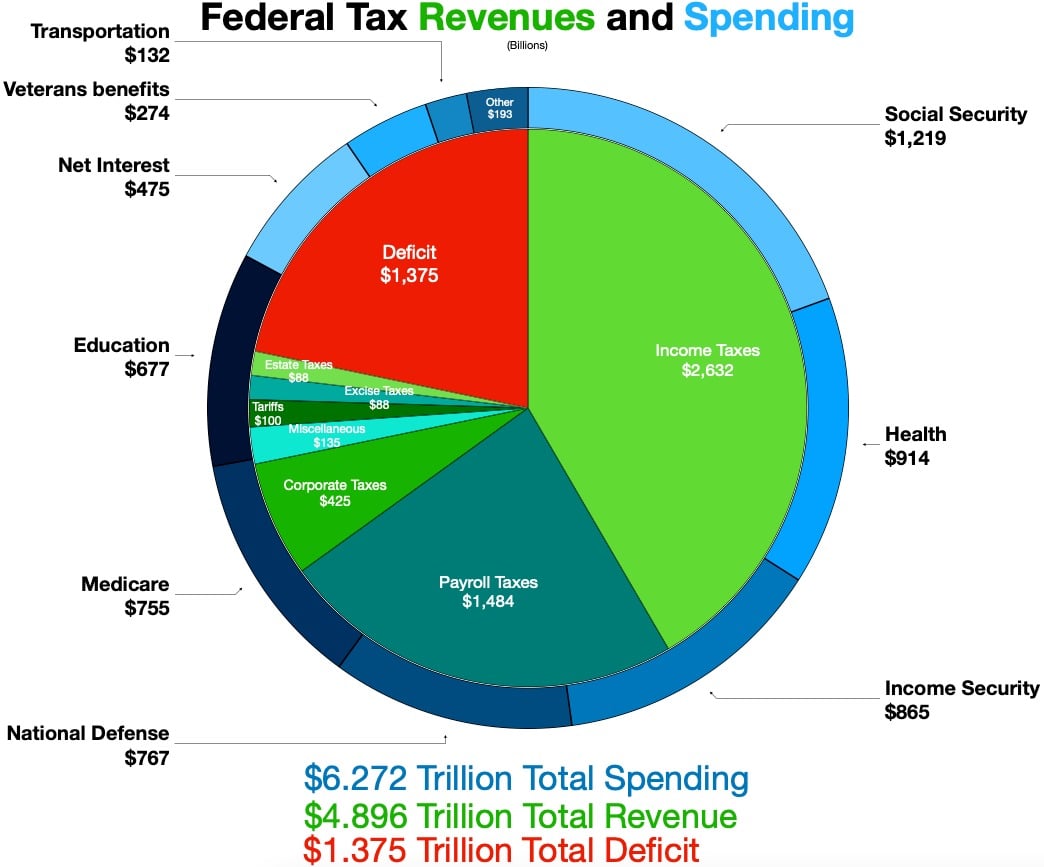

The government needs to borrow money because it spends more than it earns through taxes and other revenue sources. Their obligations include social security payments, salaries for members of the armed forces, and many other things.

How does the government borrow money?

The government borrows money by issuing bonds and other types of securities. They are sold to everyone worldwide. This includes individuals, corporations, and even other governments. The bondholders get repaid with interest when the security matures at a later date.

How much debt does the government currently have?

The government currently has $31.46 trillion in national debt. This is slightly higher than the borrowing limit of $31.381 trillion set by Congress on December 16, 2021.

Why are US lawmakers reluctant to increase the debt ceiling?

The stalemate over the debt ceiling can be attributed to a difference in opinion between the Republican and Democratic lawmakers. The Republicans have proposed a bill that increases the debt limit while reducing future government spending. The Democrats believe the two things should be dealt with separately. They want to raise the debt ceiling now and debate about the spending cuts at a later date.

What happens if US lawmakers don't raise the limit by June 1?

The short answer is nobody really knows. The US has never defaulted on its debt. That is the reason the dollar is the world's strongest currency. It is also why many foreign governments invest their extra funds in US bonds. Experts suspect the US will plunge into a recession if the federal government cannot pay its obligations on time. The default could also result in a worldwide financial crisis.

Resources: CNN.com, NPR.com, BBC.com